Table of Contents

[ Show/Hide ]If you’re starting in trading, one of the first questions you’ll face is what exactly a broker is and how to choose the right one. In this article, we’ll walk through the basics in simple terms. You’ll learn what a broker does, how it differs from an exchange, and why the type of broker you use- Market Maker, STP, or ECN- matters for your costs and execution. We’ll also cover what to check before opening an account, from regulations and fees to platforms and support, and explain the main account types most brokers offer. Finally, we’ll show you how HighFxRebates helps lower your trading costs with rebates, without changing your spreads, leverage, or execution.

What Is a Broker?

A broker is the company that gives you access to the financial markets. When you trade forex, CFDs, or other instruments, you cannot connect directly to the market on your own. Instead, the broker provides the platform (such as MT4 or MT5), handles your orders, and connects you to liquidity providers or acts as your counterparty. Brokers earn money through spreads, commissions, or both. In short, without a broker, you cannot place trades, manage positions, or fund and withdraw your account.

Broker vs. Exchange

Many beginners confuse brokers with exchanges, but they are not the same.

🔹 A broker gives you access to the forex and CFD markets with leverage. You open an account, trade through MT4 or MT5, and pay costs via spreads or commissions. Examples we support include XM and FBS, both well-known global brokers.

🔹 An exchange, on the other hand, is a platform where traders buy and sell directly with each other through an order book. Fees are charged as maker/taker. Examples we offer include Binance and Bybit, two of the largest crypto exchanges.

Both give you market access, but the products and pricing models are different. Brokers focus on leveraged forex/CFDs, while exchanges specialize in spot and futures crypto trading.

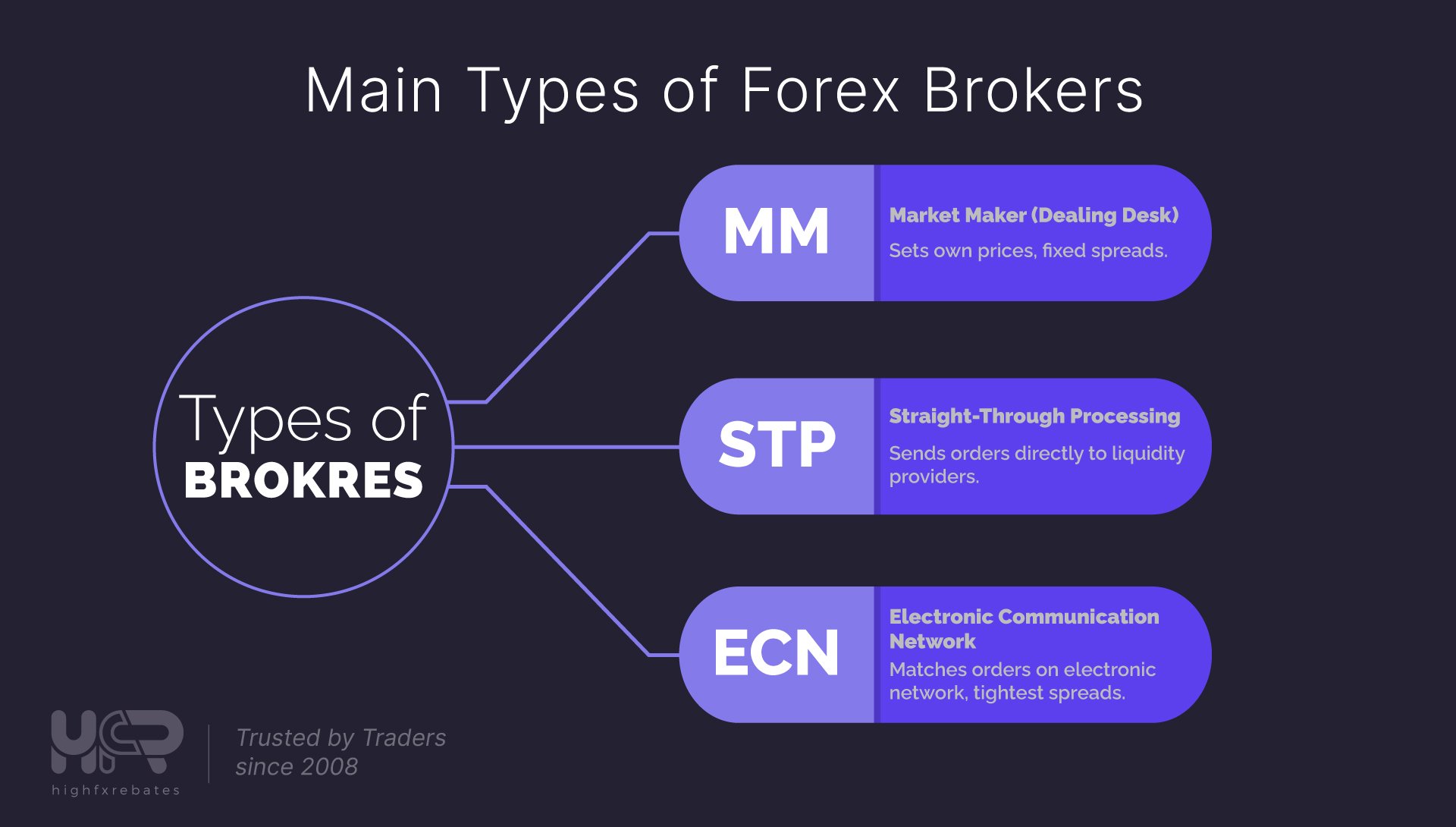

Types of Brokers

Brokers use different execution models, and knowing how they work helps you understand trading costs.

🔹 A Market Maker (Dealing Desk) sets its own quotes and often acts as the counterparty to your trades. This model is common with brokers such as XM and FBS, where Standard or Cent accounts offer spread-only pricing with no commission. It’s simple for beginners and provides stable spreads, although they can widen during volatile markets.

🔹 An STP broker (Straight-Through Processing) passes your orders directly to liquidity providers, usually with a small markup on the spread. This keeps costs close to the real market while staying straightforward. For example, Axi and Ultima Markets both provide Standard accounts that follow this model.

🔹 An ECN broker (Electronic Communication Network) connects your trades to a pool of quotes from multiple providers. Spreads are extremely tight, often near zero, but you pay a small commission per lot. ECN accounts are popular with scalpers and algorithmic traders. Brokers such as StarTrader, FxView, and LiteFinance all offer ECN or Raw accounts for traders who prefer this style.

No model is universally better; it depends on your strategy and account type. Beginners may prefer Market Maker or Standard accounts, while high-frequency or EA traders often choose ECN setups for tighter spreads.

How to Choose the Right Broker

Picking a broker is easier when you follow a simple checklist. Start with regulation. Choose a broker licensed in a reputable jurisdiction and check the entity you will join. Then look at total cost: typical spreads, commission (if ECN/Raw), swaps, and any funding or inactivity fees. Decide which account type fits your style: Standard/Market Maker (spread-only, simple) or ECN/Raw (tight spreads + small commission).

Make sure the platforms match your needs (MT4/MT5, web, mobile, copy trading, VPS). Confirm your markets: forex, metals, indices, commodities, shares/ETFs, or crypto CFDs. Finally, review payments (local deposit/withdrawal options and processing times) and support quality.

Examples: Beginners often start with Standard accounts at brokers like XM or FBS. Active or EA traders may prefer ECN/Raw at HFM, RoboForex, or Ultima Markets for tighter pricing.

Remember: opening or linking through HighFxRebates returns cashback on eligible trades without changing spreads, leverage, or execution.

🔹 Compare brokers and rebate rates side by side 🔹 Compare account types 🔹 How rebates work

Broker Account Types

Most brokers offer more than one account type. The choice you make will affect your spreads, commissions, and the way rebates are paid.

- A Standard account is the simplest. You only pay through the spread, and there is no separate commission. This is the default setup at brokers such as TMGM, where it suits beginners who want straightforward costs.

- An ECN or Raw account offers the tightest spreads, often close to zero, but you pay a small commission per lot. These accounts are popular with scalpers and algorithmic traders. Ultima Markets offers ECN/Raw options for traders seeking the lowest pricing.

- Cent or Micro accounts work just like Standard or ECN, but the trade size is much smaller. This lets beginners practice with less risk. The rebate rate is the same, but because one cent-lot equals 1/100 of a standard lot, the cashback amount is smaller. For example, if a Standard account earns $6.40 per lot, a Cent account trade earns $0.064 for a cent-lot.

Some brokers also offer Swap-Free or Islamic accounts, which remove overnight interest and instead apply an admin fee. See the HFR account type comparison with rebate rates

How Rebates Lower Your Trading Costs

Every trade has a cost, whether it’s a spread, a commission, or both. Over time, these costs add up, especially for active traders. Rebates (cashback) are a way to get part of those costs returned to you.

When you open or link your account via HighFxRebates, we share back up to 90% of the broker’s revenue as cashback. This means you receive money back on every eligible trade, no matter if it ends in profit or loss. Your spreads, leverage, and execution stay exactly the same; rebates are an extra saving on top of your normal account.

For example:

- On a Standard account at FBS, you can now earn 38.7% of the spread back.

- On a Raw account at Tickmill, you receive $2 + 5% commission reduction.

See the Highest Rebates List. Rebates are usually credited daily, weekly, or monthly, depending on the broker. They reduce your effective trading cost and make long-term strategies more sustainable.

Activate your cashback today and start saving while you trade.

Frequently Asked Questions

1. What exactly does a broker do?

A broker gives you access to the trading market. It provides the platform, connects you to liquidity providers or acts as your counterparty, and handles deposits, withdrawals, and order execution. Without a broker, you can’t trade forex or CFDs directly.

Learn more in the Forex Brokers Comparison.

2. What’s the difference between a broker and an exchange?

A broker lets you trade leveraged products such as forex and CFDs, usually on MT4 or MT5, and earns through spreads or commissions. An exchange matches buyers and sellers directly on an order book, mainly for spot or futures crypto trading. See examples in the Crypto Exchanges Comparison.

3. Which broker type is best: Market Maker, STP, or ECN?

There’s no single best option. Market Maker or Standard accounts are simple for beginners.

ECN or Raw accounts offer tighter spreads for scalpers and high-volume traders. Compare all models and account types side by side.

4. Do rebates affect my spreads or trading conditions?

No. Rebates are paid separately by HighFxRebates and do not change your broker’s spreads, leverage, or execution. You trade normally and receive cashback weekly.

Are you new to Rebates (Cashback)? Read What Are Forex Rebates?

5. Can I get rebates if I already have a broker account?

Yes, in most cases. Many brokers allow an IB transfer, so your existing account can be moved under HighFxRebates. After confirmation, your trades will start earning cashback automatically.

Steps are shown in each broker’s page under the Rebates & Cashback tab.

6. How and when are rebates paid?

Rebates are credited daily, weekly, or monthly, depending on the broker’s payout schedule.

Final Words

Choosing the right broker is one of the most important steps in your trading journey. It affects how much you pay in spreads, the quality of your execution, and your overall trading experience. By understanding how brokers work and comparing their account types, you can make smarter decisions and avoid unnecessary costs.

At HighFxRebates, we help you trade under the same broker conditions but earn money back on every eligible trade. It’s simple, transparent, and built to lower your real trading costs. Check rebates list and start earning rebates today.

Disclaimer: Trading forex, CFDs, and cryptocurrencies carries risk. HighFxRebates is not a broker or financial adviser. Rebate payments depend on broker confirmation and may vary by region. T&Cs apply.